The Value of Marketplaces in Hedging

Hedging Marketplaces work. Would you buy an airline ticket for personal travel without checking prices across airlines? A hotel? A rental car? Would you buy a share of stock from an acquaintance without checking the current market price? Would you buy a car at the first dealer you visited without comparing pricing?

Probably not – especially in a time when information is available in real-time with a few simple clicks.

They bring buyers and sellers together at the same time for the same product with the same information – resulting in transparent pricing and efficient execution. Hedging should be no different. In order to conduct transparent pricing, hedgers and their financial counterparties (“Dealers”) must be looking at the same product – with the same structure, volume, and tenor – at the same time. Markets are constantly moving and “current price” matters.

Transparent Pricing is Nearly Impossible Outside of a Marketplace

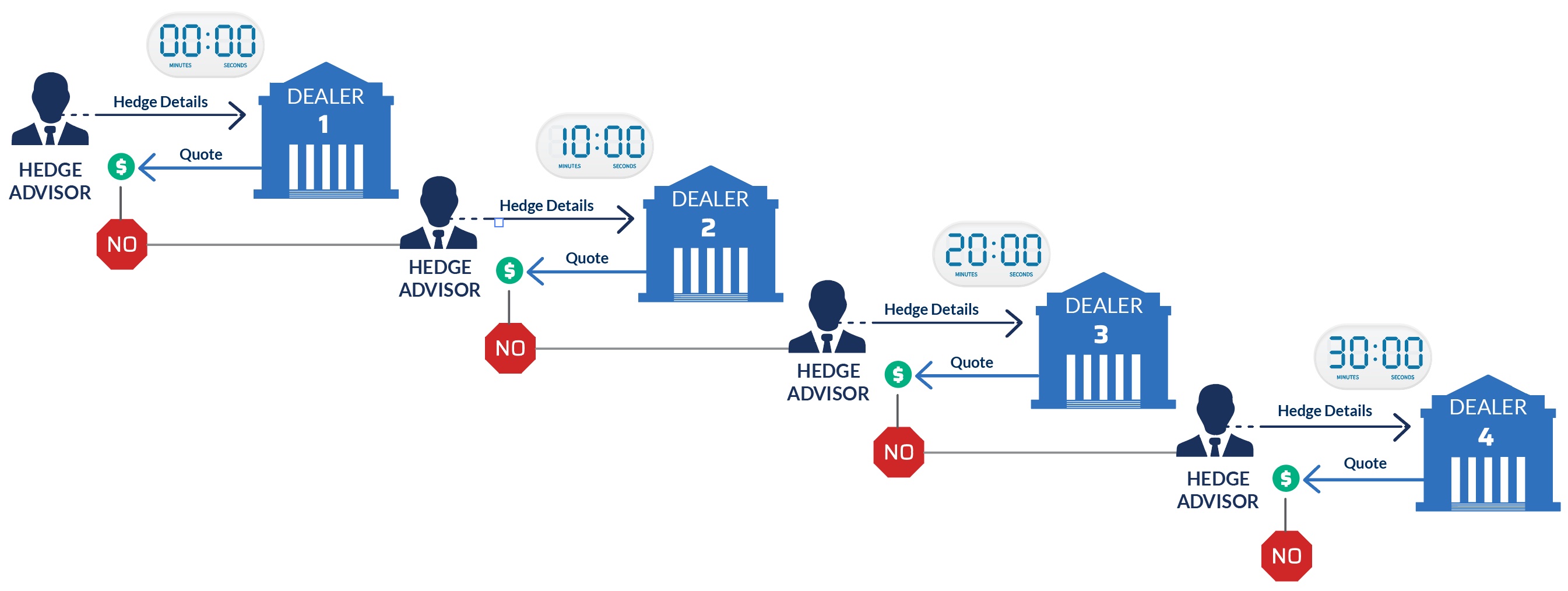

Some hedgers and hedge advisors (who negotiate hedging transactions on behalf of clients) do not seek multiple simultaneous bids. They, instead, engage a single Dealer at a time and only move to another potential Dealer if trade terms cannot be agreed upon.

This “serial” approach places the hedger at a disadvantage because:

1. With no competitors in play, the Dealer does not have to provide a “best” quote – only a quote that is “good enough” to prevent you from moving to the next Dealer;

2. Any Dealer that bids and is not selected can potentially use the trade information to the hedger’s detriment in the open market;

3. Even though markets are constantly moving, a Dealer – once eliminated – is not afforded the opportunity to adjust its quote to reflect current market conditions;

4. Some Dealers will be unnecessarily excluded from trades when terms are agreed upon before those Dealers are even aware of the trade; and

5. Most importantly, it is not possible to make an “apples to apples” comparison since each quote reflects different market conditions.

In short, a hedger cannot possibly know if the “best price” was achieved when executing serially. The same is true when multiple quotes are being collected by phone since, by definition, these quotes do not reflect concurrent market conditions.

Marketplaces Close These Gaps and Permit Transparent Pricing

Hedging marketplaces (like AEGIS Markets) enable multiple Dealers to participate simultaneously in a transaction.

This enables transparent pricing because the marketplace:

1. Issues hedge details to all Dealers at the same time – avoiding potential front-running;

2. Uses a set of rules and processes to ensure Dealer is treated fairly and consistently;

3. Collects real-time quotes in a central location to enable meaningful quote comparison;

4. Allows each Dealer to adjust its quote as the market changes;

5. Permits the hedger to select any quote for any reason at any time (even if the quote is not the best price);

6. Automates all downstream trade capture, confirmation, and reporting; and

7. If a hedger desires a serial execution approach for some reason… marketplaces can accommodate this approach as well.