Our Story

SEF: Swap execution facility story

October 2019

Original Idea: Apply Technology to Make Hedging Markets Better

January 2020

Initial Prototype Created

February 2020

CFTC Stated SEF Registration is Required

FEBRUARY 2021

SEF Application Submitted

SEPTEMBER 2021

CFTC Published Staff Advisory 21-19

JULY 2022

AEGIS Markets Approved by the CFTC

AUGUST 2022

First Participants Join AEGIS Markets

SEPTEMBER 2022

First LIVE Trades

december 2022

10th Dealer Joins

JANUARY 2023

Volume Increases in 4Q22

JANUARY 2023

15th Dealer Joins

APRIL 2023

Record Volume in 1Q23

may 2023

20th Dealer Joins

JULY 2023

Trading Activity Accelerates in 2Q23

SEPTEMBER 2023

New Capability for Clients to Trade Directly on AEGIS Markets

OCTOBER 2023

Record Trading Activity in 3Q23

november 2023

25th Dealer Joins

DECEMBER 2023

Passed 500k Total Lots Traded

APRIL 2024

Record trading activity in 1Q24

May 2024

OTC Platform of the Year

June 2024

30th Dealer Joins

OCTOBER 2024

1,000,000 lots transacted (equivalent to 1 billion barrels of crude oil)

February 2025

Dealer Dashboard Launched

March 2025

Record Trading Activity in 1Q25

May 2025

OTC Platform of the Year Again!

June 2025

35th Dealer Joins

June 2025

Record Trading Activity in 2Q25

As hedge advisors to hundreds of leading companies, we decided to build a hedging marketplace – because marketplaces are the best way to conduct transparent pricing as outlined here:

That decision took us on a journey we never expected – and today that hedging marketplace (known as AEGIS Markets) is thriving. We did not set out to be a swap execution facility (SEF). In fact, we never considered the possibility. We learned a lot and are sharing how we got here and our progress since launch.

Why? Because we know there is confusion in the marketplace and that confusion can lead some to guess, speculate, and/or spread misinformation. That isn’t necessary when the facts are available. So we are showing our work – complete with the documents we reviewed with the CFTC, rulebooks, key dates, etc.

Organizations with exposure to volatile commodity prices now have access to a modern hedging marketplace. That is what matters. The information below can be a bit technical – and only exists as a reference when speaking with someone who claims to have insight into regulations or facts impacting AEGIS Markets. We hope it is helpful.

1. Is SEF registration something AEGIS wanted?

Absolutely not. Below you will see we spent significant time, effort, and money challenging the Swap Execution Facility (SEF) registration requirement and (unsuccessfully) attempting to change the perspective of the Commodity Futures Trading Commission (CFTC). For a long time, courts have long given deference to regulators interpreting their own rules. As such, when the CFTC ultimately said we needed to register, we swallowed hard and moved forward.

2. How did the regulatory discussion begin?

Very innocently. We envisioned a hedging marketplace that would enable transparent pricing and efficient post-trade execution that wasn’t possible through instant messaging (ICE Chat) and phone-based swap negotiations (herein referred to as “online CTA platform”). In May 2019, outside counsel performed an analysis of the lawfulness of creating this online CTA platform.

3. Did the legal analysis comment on SEF registration?

Yes. While the opinion is subject to attorney/client privilege, it did raise the SEF registration question. Our position was hedging transactions we facilitated as “one to many” rather than “multiple to multiple” because every transaction is between a single customer and multiple financial counterparties (Dealers). We took certain steps suggested in the legal opinion that (we believed) would allow us to operate without registering – and proceeded without speaking to the CFTC.

4. What led AEGIS to speak with the CFTC?

In January 2020, we introduced our online CTA platform to Dealers. Counsel at one Dealer advised the online CTA platform might be a SEF and suggested we speak with CFTC Staff. Our outside counsel approached the Division of Market Oversight (DMO) at the CFTC without disclosing AEGIS as the company (referring to AEGIS as “Firebird”). The DMO could not provide definitive guidance given the informal nature of the inquiry but advised we were “asking the right questions.”

5. Did you formally engage with the CFTC at that point?

Yes. After multiple discussions internally and with the CFTC over several weeks, we (still anonymously) submitted this SEF Inquiry to CFTC DMO Staff in late February 2020 – clearly positioned AGAINST SEF registration.

6. Did the CFTC agree with your position?

No. On February 27, 2020, having considered our conversations and memo, the CFTC concluded we were subject to SEF registration. In simple terms, we misunderstood the application of the “multiple to multiple” definition – and what constituted a trading facility.

7. Did AEGIS register based upon this decision?

No. We decided to abandon the online CTA platform. We considered limiting our technology to a “plug-in” that would publish and track transactions in “chats.” We (still anonymously) presented the following memo to the CFTC to assess if the plug-in would trigger SEF registration. Plug-In Integrated with Chat Functionality Memo.

8. Did the “plug-in” trigger SEF registration?

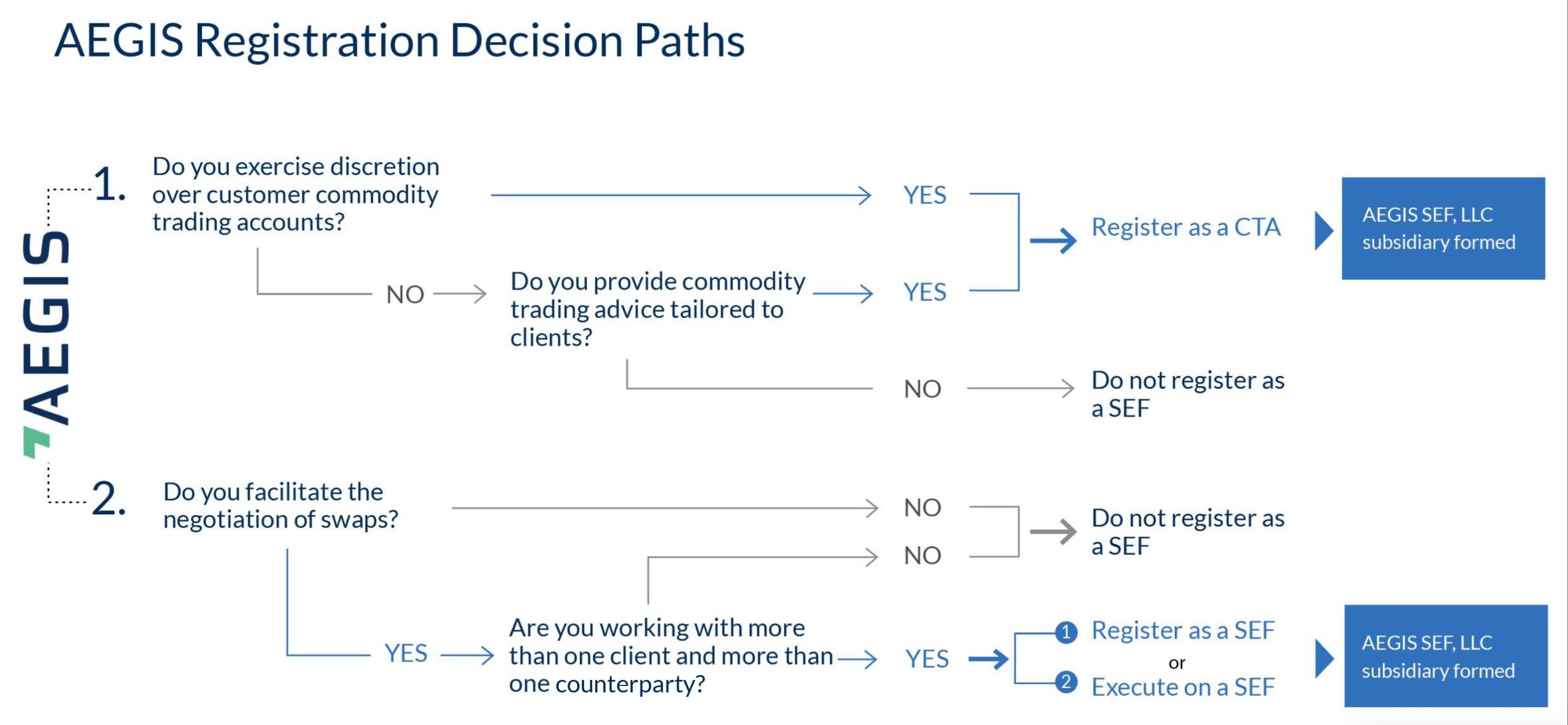

No. But it turns out the online CTA platform didn’t trigger it either. We had been looking at the issue incorrectly. While we were correctly registered as a CTA in our role advising customers on the appropriateness and structure of swaps, Staff at the CFTC was purely focused on our role in facilitating the negotiation of these swaps. Regardless of whether we facilitated these negotiations through chats, phone calls, emails, or an electronic marketplace, this facilitation activity requires SEF registration. The graphic below illustrates the decision paths we needed to pursue:

9. How did the CFTC explain the registration requirement to you?

CFTC Staff wrote: “AEGIS CTA has represented it offers a [voice] RFQ system whereby each RFQ involves one customer using AEGIS CTA to seek quotes from one or more swap dealers, and multiple customers are able to utilize the RFQ system. Thus, DMO staff opined the AEGIS CTA [voice] RFQ system is “a trading system or platform in which multiple participants have the ability to execute or trade swaps by accepting bids and offers made by multiple participants” and meets the SEF definition. The SEF registration applies to all facilities meeting the SEF definition and listing swaps that are subject to CFTC jurisdiction, including commodity swaps such as oil and gas swaps.”

In short, we perform a function in which we a) have more than one customer and b) facilitate swaps with more than one Dealer. Even though hedges are negotiated on behalf of a single customer at a time – and regardless if it is done via voice, chat, or electronic platform – we were subject to the SEF registration requirement.

This did not impact our ability to provide hedge advisory services to customers. It simply meant that we had to register as a SEF if we wanted to continue facilitating swap transactions on behalf of our customers.

10. Were you able to rely upon the exclusion from the SEF definition for a one-to-many platform where the sponsoring entity is the counterparty?

No. A hedge advisor is not “the counterparty to all swap contracts…” so this portion of the rule does not apply us. We understand this language to apply to Dealers executing directly with customers.

11. What choice did that leave you?

We could:

a) Register as a SEF, or

b) Execute hedges on an existing SEF; or

c) Cease facilitating hedges on behalf of customers, or

d) Challenge the CFTC on its interpretation of its own rules.

The choice for us was simple. Our customers needed support, there was not a SEF that facilitated bilateral commodity swaps, and we didn’t care to engage in a protracted legal fight that we were unlikely to win. We filed our SEF application on February 3, 2021.

12. Are other similar hedge advisors required to create a SEF?

We don’t know. The recent CFTC actions and commentary seem to confirm what we learned:

1. On September 29, 2021, the CFTC issued Staff Advisory Letter 21-19

2. On the same day, the CFTC took enforcement action against Symphony Communications

3. On September 26, 2022, the CFTC took enforcement action against Asset Risk Management

13. What happens if a hedge advisor operates a SEF (as interpreted by the CFTC Staff), but doesn’t register?

We don’t know. Looking at the precedents set above, there is likely to be a fine and, most importantly, a cease-and-desist order preventing the hedge advisor from facilitating hedges for customers.

14. Are there conflicts being a hedge advisor and a SEF?

No. In fact, a hedge advisor cannot be a SEF precisely to avoid conflicts. As such, we established two separate regulated entities. AEGIS CTA, LLC advises customers on their hedge programs. AEGIS Markets, LLC operates the regulated swap execution platform under a CFTC-approved Rulebook. Any CTA (including AEGIS CTA), can utilize AEGIS Markets to execute hedging transactions. Read more about the actions we have taken to avoid conflicts here.

15. Did you bring back the online CTA platform?

Yes. A much better version. Our approved hedging marketplace distributes trade information impartially, collects bids and offers simultaneously, performs surveillance, executes transactions, feeds downstream systems, creates auditable records, and enables insightful analytics. In short, we are able to perform transparent pricing and efficiently execute.

16. How many Dealers are executing hedges on AEGIS Markets?

Thirty-seven (37) Dealers have signed definitive documentation to execute swaps on AEGIS Markets – including U.S. money center/regional banks, Canadian banks, and non-bank swap dealers. See our latest 2024 press release for reference.

17. Is there more than one way for hedge advisors to execute hedges on AEGIS Markets?

Yes. Hedges can be executed through either the:

a. Request for Quote (RFQ) Function, or

b. Offline Execution Functionality (OEF), or

c. Central Limit Order Book.

Multiple execution methods provide Dealers flexibility to engage on AEGIS Markets as they complete technology diligence. Each method is detailed in Sections 4.7, 4.8 and 4.8A beginning on Page 48 of our published Rulebook.

18. How many hedges have been executed on AEGIS Markets?

Over 510,000 contracts have been executed on AEGIS Markets through December 2023. You can see AEGIS Markets’s momentum through our publicly reported volumes.

19. Are there fees to execute hedges on AEGIS Markets?

Yes. It is free for Participants and Dealers to participate; however, the winning Dealer in a transaction pays a small fee to cover technology and regulatory expenses (one-third of a tick). Learn more about SEF transaction fees here.

20. Do some Dealers perform their own regulatory reporting?

Yes. AEGIS SEF reports for most Dealers; however, Dealers have the option to maintain reporting if they prefer to limit any internal process changes. Click on the Rulebook link above and review Section 4.18.4 beginning on Page 64 to learn more. See all compliance documents here.

21. Has AEGIS reconfirmed the SEF registration requirement with the CFTC in light of ongoing “market confusion?”

Yes. Many times. Most recently, on March 2, 2023, we reviewed multiple swap facilitation scenarios with DMO Staff. The intent was to determine which, if any, of the scenarios would trigger the SEF registration requirement in the event AEGIS CTA were to alter its business model. We won’t speak on behalf of DMO Staff; however, we have noticed that they have been very consistent in their interpretation – and other hedge advisors would be well-served to have a similar conversation. Here is the document we reviewed.

22. Have other hedge advisors approached the CFTC?

We don’t know. Below are some questions to ask any hedge advisor proposing to manage your hedging program:

1. Can I see your hedging marketplace?

2. How do you perform real-time price discovery if you can’t collect quotes simultaneously?

3. Do you have more than one customer?

4. Do you work with more than one Dealer?

5. Have you spoken with the CFTC to confirm if your business is not subject to SEF registration?

6. Can I see that correspondence?

You need a hedge advisor that can negotiate with multiple Dealers simultaneously. And you need a hedge advisor that is executing hedges in compliance with regulations.

Like more detail?

Fortunately, the CFTC clarified SEF registration requirements in September 2021. This document includes AEGIS notes alongside the actual CFTC Advisory 21-19.

What could that conversation with the CFTC look like?

Our company uses an advisor to (i) advise us on hedge strategy and/or (ii) negotiate hedging transactions with financial counterparties on our behalf. We have more than one financial counterparty bidding on each hedge transaction. And we believe our hedge advisor has more than one customer. Based on these facts, do the hedging transactions negotiated by our hedge advisor need to be executed on a Swap Execution Facility (SEF)?

Hearing something different?

In the end, the CFTC has the final say.

If you are receiving conflicting information, please contact the CFTC anonymously and simply describe the work your hedge advisor performs or proposes to perform.

For questions, please contact the CFTC directly

by visiting www.cftc.gov or by calling 202-418-5000. A specific list can be found here.

To reach the Division of Market Oversight, please refer to the contact information provided in Staff Advisory 21-19 to reach specific contacts. You can find that here.

BENEFITS