Hedge your commodity exposures on a digital marketplace.

How it works:

Trade Creation

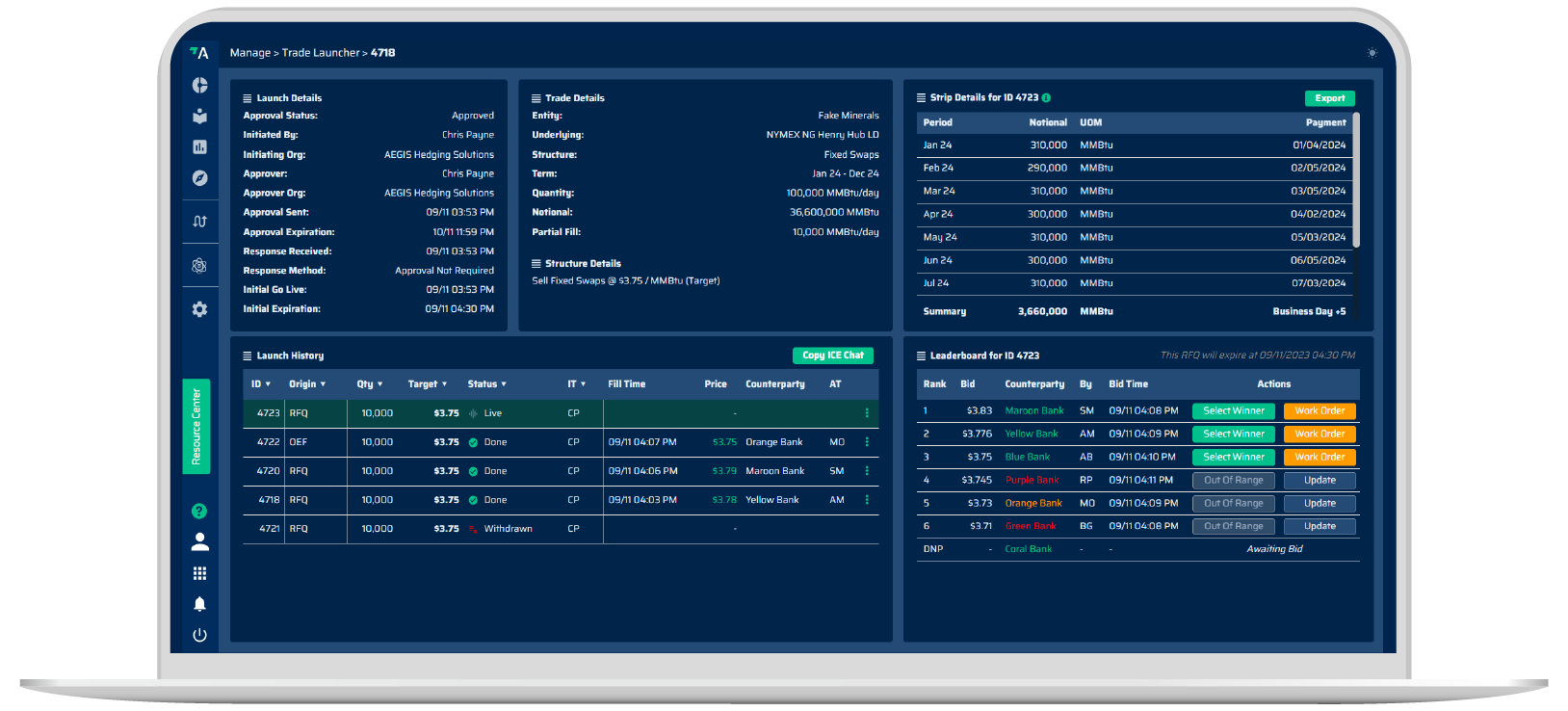

Create trade details once and automatically notify all participating dealers with the push of a button

Bidding & Execution

One simple screen to manage bidding and award trades, dealers get the “last look” before a deal is “done”

Trade Booking

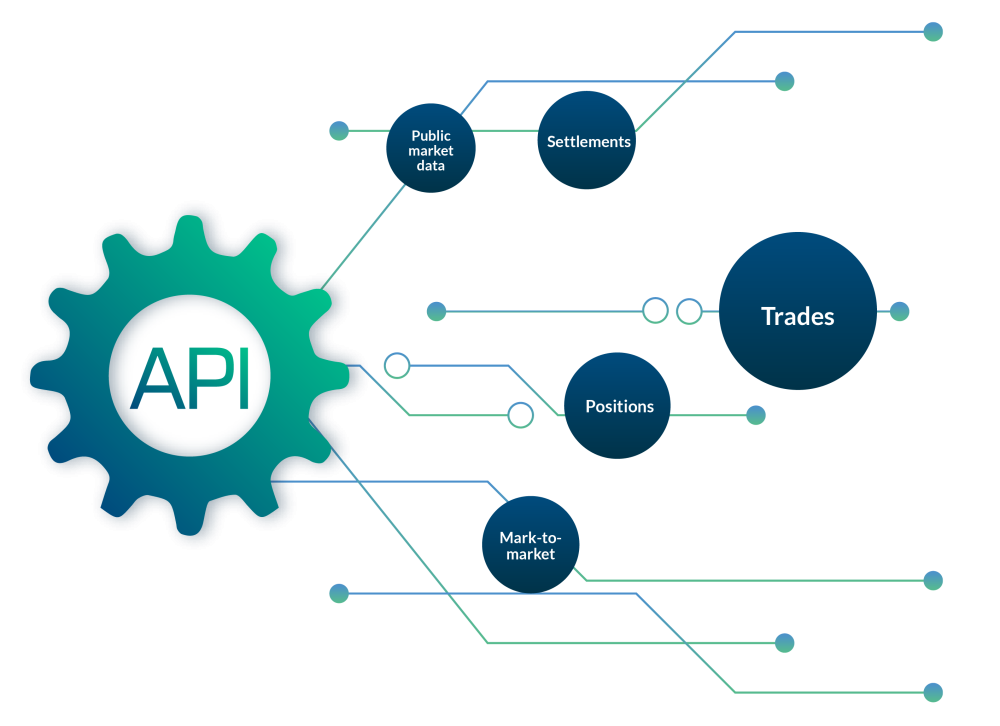

Straight through processing API automatically loads trades into downstream systems, avoiding mistakes & re-typing

Analytic Insights

View hedge percentage, bid feedback, win/loss ratio, participation statistics, and other trends in real time

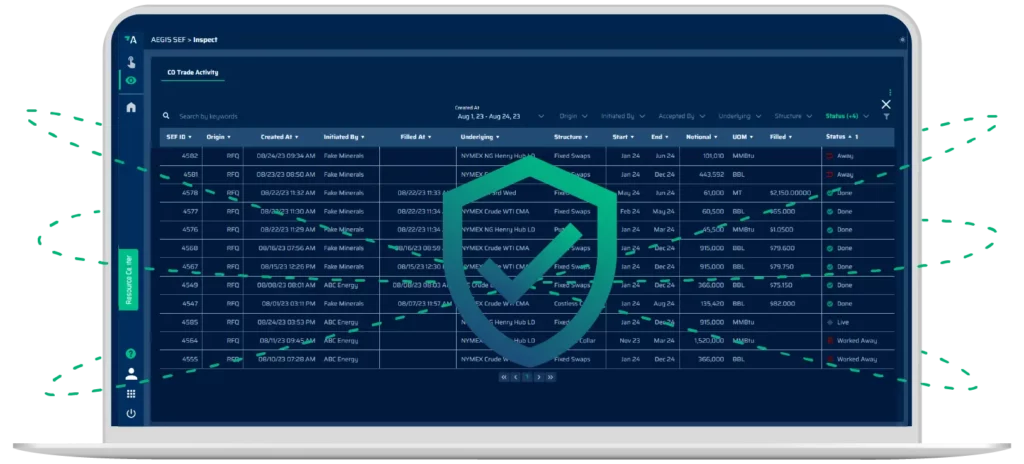

CFTC Compliance

Surveillance and compliance reporting included, flexible SDR reporting options for dealers, online audit trail for everyone

- Transparent Pricing

- Efficient Execution

- Trade Analytics

- Automatic Trade Booking

- Robust Compliance

- API Integration

Transparent pricing identifies price differences, so that you can capture the best price before the market moves, with quantified execution savings.

Simultaneous participant communication displays a clear bidding leaderboard, provides last-look confirmation for the winning price, and ensures an online audit trail for trade reconstruction.

Track participant engagement and bid activity, deliver detailed feedback and deal insights, analyze win/loss ratios and trading trends, and benchmark Marketplace performance for continuous improvement.

Completed trades flow automatically for valuation, avoiding manual effort, delays, and data entry mistakes.

|

|

• Inbound API for compliant execution on SEF

• Outbound API automatically loads trades downstream

• Enables secure, streamlined access to needed data

100% Reporting Accuracy

Comprehensive end-to-end deal capture for critical governance.

“Very user friendly on the front end, easy to work orders, price fit to curve, and all needed option structures”

-Dealer

“Seeing the status of all my bids on one screen saves me a ton of time”

-CORPORATE

“I create trade details once and that’s it! No need for multiple chats or manual re-caps–the system just does it”

-advisor

“The API makes it nice and easy to work on AEGIS Markets. There are times when we can see 5 trades at once; this makes it easy to keep compliance happy with timely entries to the SDR. Issues with the 15 minute reporting window are a thing of the past when I deal swaps on AEGIS Marketplace.”

“The API is saving a lot of time, and more importantly helping avoid errors”

-DEALER

Join the Industry-Leading Hedging Marketplace.

AEGIS Markets (U.S.) LLC, a subsidiary of AEGIS Hedging Solutions, is a Swap Execution Facility approved by the Commodity Futures Trading Commission (“CFTC”). AEGIS Markets operates markets for commodities and other instruments. AEGIS Markets offers a venue for trading in uncleared bilateral OTC swaps through a central limit order book (CLOB), request for quote (RFQ) system, and Offline Execution Functionality (OEF).